ROE in Share Market: How to Calculate, Its Uses, & More

According to research companies with higher ROE tend to outperform their competitors over time, which enables them to make smarter investing decisions. In this blog, we’ll discuss what is ROE in the share market, its role, application, constraints, etc.

What is ROE in Share Market?

ROE or Return on Equity is a measure of financial performance calculated by dividing net income by shareholders’ equity in the share market. ROE is the return on net assets and it shows how efficiently a company uses its equity financing to generate income from the investments made. A higher ROE means that the management has generated more profits. This implies that a profitable company will be less reliant on debt or capital raises to fund new projects or expand operations.

Additionally, a higher return on equity indicates that investors are getting a better value from each investment in stock than investing elsewhere with lower ROE ratios. ROE is not only a measure of financial performance but also an indicator of how likely the company will be able to sustain future growth. With a higher return on equity comes the confidence that management has utilized its resources efficiently and can continue doing so to ensure continued profitability and success.

Furthermore, looking at other factors such as total liabilities or net income alongside Return on Equity helps investors get a better assessment of where their money will yield the best results when considering possible investments – giving them that extra edge needed when assessing market opportunities across markets. You can also learn about all the intricacies of the stock market and how it works, by taking a course to learn stock market trading.

How to Calculate ROE in Share Market?

The formula for calculating ROE in the share market is as follows:

| Return on Equity = Net Income / Equity of the Shareholders |

There are two elements to estimate ROI: net income and shareholders’ equity.

- Net income is a measure of a company’s financial performance which takes into account all costs associated with generating revenue. It can be calculated by subtracting total expenses, such as interest and tax payments, from the money made during an accounting period. This method offers greater accuracy than other forms of measuring profitability like gross or operating income since it incorporates additional cost elements across its calculations.

- Shareholder equity is the amount of capital invested in a company by its owners. It represents their financial contribution to the business and can be seen as what would be returned to them if they ever had to liquidate their stake within it. Shareholder equity provides investors with insight into how much value they could receive if all liabilities have already been paid off and any remaining assets are sold at fair market prices.

Also Read: What is Dividend in Share Market

Here’s a table to substantiate this:

| Factors | Amount |

|---|---|

| Shareholders’ Equity | $580,000 |

| Net Income | $350,000 |

To calculate use the formula: ROE = Net Income / Shareholders’ Equity. In this example:

ROE = $350,000 / $580,000 = 0.603

ROE as a percentage = 0.603 x 100 = 60.3%

The company’s Return on Equity is 60.3%.

How to Calculate ROE Using Excel?

Here is how to use Microsoft Excel to calculate a company’s Return on Equity (ROE):

- Start by adjusting the width of columns A, B, and C. Right-click on column A and select “Column Width” from the menu that appears. Enter 30 default units into the field provided and click OK to confirm this change; repeat for both Columns B & C when desired changes have been made.

- Enter each company name in cells B1 and C1 respectively followed by “Net Income” in cell A2 then “Shareholders’ Equity” in cell A3 finally type ‘Return on Equity” into cellA4

- In order to compute ROEs, enter the formula for “Return on Assets” =B2/B3 and =C2/C3 into cell C4.

- Enter the Net Income and Shareholders’ Equity values in cells B2, B3, C2, and C3 accordingly to complete calculations of Return on Equity (ROE).

4 Uses of ROE in Stock Market

The usefulness of ROE cannot be overlooked in the shares market. Here are some of the uses of ROE in the shares market.

1. ROE in Evaluating Companies’ Performance

The ROE in Share Market tells you a lot about the financial health, growth potential, and performance of a company. To accurately assess a firm’s financial prospects it is best to compare its ROE against that of similar businesses within the same industry or sector. Unusual high/low figures could point toward hidden risks which require further investigation. Examining other metrics alongside this data will help investors make informed decisions regarding where best to allocate their capital for maximum returns.

2. Identifying Problems

It is important to understand that a high ROE can sometimes be indicative of potential problems. Three common issues which can lead to an inflated return on equity are

- Inconsistent Profits: Inconsistent profits may happen if a company has been unprofitable for several years and then returned to profitability; this could make its ROE misleadingly high because the denominator in the calculation will become very small after so many losses being recorded as “retained loss” on the balance sheet

- Excess Debt: Excess debt is another potential issue since borrowing heavily causes equity value to fall due to the assets minus debts equation associated with it.

- Negative Net-income: Negative net income or shareholders’ equity could also create an artificially higher rate of return. When a company has negative net income and shareholders’ equity, it is not advised to calculate its ROE in order to get an accurate assessment of the business performance.

3. Analyzing Stocks Before Investing

ROE can be used by traders and analysts alike to gain insight into different stocks they may be considering trading or investing in. This helps them make more informed decisions about where best to allocate funds. Experienced financial professionals use ROE figures when making estimates and forecasts of future performance for various stocks. This helps them determine whether a company’s past success is likely to continue into the near term. Also giving insight as to how much risk may be involved if they were to invest.

4. Helps Investors Scrutinize Businesses

ROE can also provide investors with an indication as to how well management has been managing their capital over time; comparing current ratios against previous ones year-on-year. Also comparing different companies in the same industry sector might reveal shortcomings that warrant further scrutiny before any decisions are made.

Also Read: What is FPO in Share Market

Constraints of ROE in the Share Market

Having a high Return on Equity (ROE) might seem like good news, but it’s not always positive.

- A high return on equity (ROE) may not always be an indication of positive performance if it is caused by volatile profits or excessive debt. This suggests that the company’s success might not last in the long run, as its profitability isn’t reliably consistent.

- Fluctuations in Return on Equity (ROE) from one period to the next can potentially be an indication of inconsistent use of accounting methods, which makes it hard to rely upon ROE as a reliable measure for judging company performance.

- When a company has negative shareholders’ equity or posts net losses, its Return on Equity (ROE) goes into the negative. This makes it impossible to use ROE as an indicator for analysis and comparison with other companies that have positive returns. In such cases, loss on equity is used instead of ROE in order to evaluate performance reliably.

- Comparing companies within the same industry using Return on Equity (ROE) may be useful, however, ROE is not an appropriate metric for assessing performance across industries due to variations in operating margins and financing structures.

Example of Return on Equity

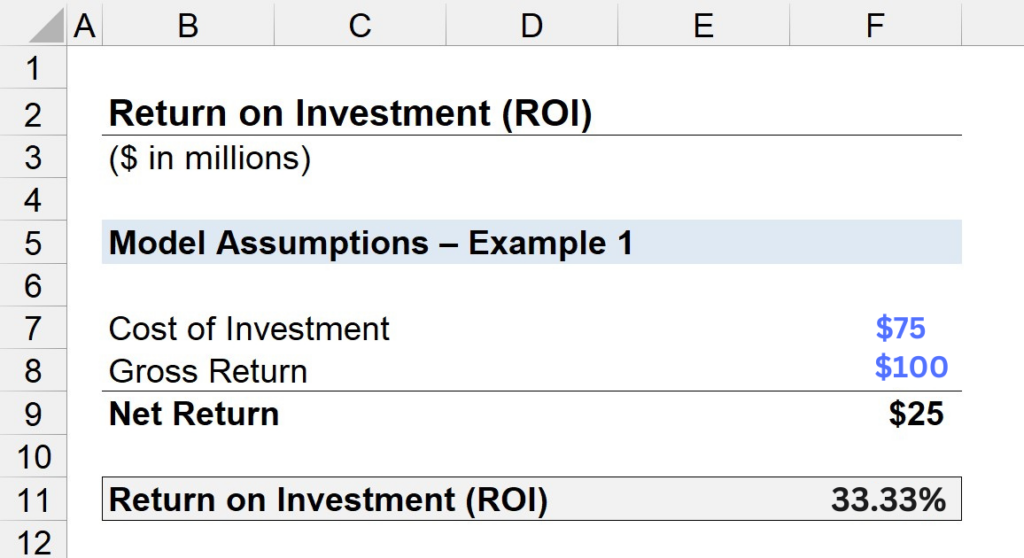

Let’s say, for instance, to invest in new machinery and upgrade their factory, an industrial company spent $75 million on capital expenditures (Capex). After the anticipated holding period, they received total earnings amounting to $100 million. This resulted in a net return of ($100m -$75m) = $25 million for this investment. By dividing this figure by its cost of investment, we can calculate Return On Investment (ROI) as

ROI = [($75m/$100m)] x 100% = 33.33%.

Hence this particular investment generated a 33.33% Return-On-Investment for the said industrial company.

Given the $25m net return and $75 million investment cost, the ROI is 33.33%, as shown in the screenshot below.

The Difference Between ROE, ROI, and ROA

This table presents a comparison of Return on Equity (ROE), Return On Investment (ROI) and Return On Assets (ROA). It illustrates the distinctions between them.

| Formula for Calculation | Meaning | Details | |

|---|---|---|---|

| Return on Equity (ROE) | Net Income / Shareholders’ Equity | Return on Equity (ROE) is a measure of financial performance that reveals how much the company’s management has earned from its assets. | ROE is used to show how well managers use resources in order to get optimal returns from investments and, thus, provide benefits for stakeholders. |

| Return on Investment (ROI) | (Net Profit / Cost of Investment) x 100% | Return on Investment (ROI) measures how profitable an investment or group of investments was relative to their cost | ROI signifies the rate of return relative to its original cost. |

| Return on Assets (ROA) | Net Income / Average Total Assets | Return on Assets (ROA) evaluates profitability in relation to all company assets and gives an indication of the effectiveness with which management is using its resources to generate profits. | ROA measures how successfully assets are being utilized by a firm for generating revenue as an indicator of overall financial success. |

Conclusion

Investing in the stock market can seem a bit overwhelming at first, but it’s so important to familiarize yourself with key metrics such as Return on Equity (ROE in the share market) if you want to make smart decisions. ROE is one of the best ways for measuring how well companies are performing financially and how successful they’ve been when it comes to generating profits.

FAQs

The ratio of net income to shareholders’ equity is known as the ROE. It demonstrates how lucrative a firm is about its equity. A greater ROE indicates that equity is being used more effectively. A good ROE varies by industry and stage of growth, although 15% or above is frequently considered desirable.

ROE calculation involves taking the company’s net income and dividing it by its average shareholders’ equity – which equals out as assets minus liabilities – essentially measuring the return generated from those net tangible investments of the company. As the equity figure can fluctuate during a given accounting period, an average shareholder’s equity is used to reflect this more accurately.

If ROE for a particular company comes out negative, it implies that net income is also negative – therefore investors are not making any return from their investments and ultimately losing money. This may be expected with new or fast-growing companies.